BlackRock dumped $1.2 billion of these cryptocurrencies in the last week of January

![]() Cryptocurrency Feb 1, 2026 Share

Cryptocurrency Feb 1, 2026 Share

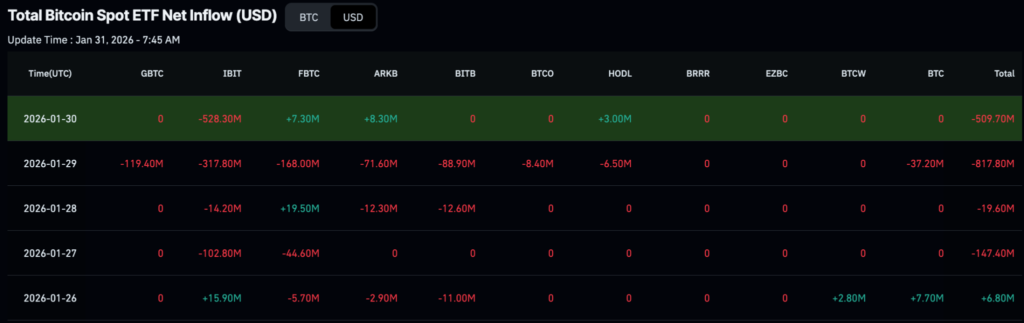

The ongoing cryptocurrency market sell-off has been reflected in declining institutional interest in digital assets, with BlackRock reducing its exposure to Bitcoin (BTC) and Ethereum (ETH).

Indeed, during the last week of January, the world’s largest asset manager recorded combined outflows of about $1.2 billion from its Bitcoin and Ethereum spot exchange-traded funds (ETFs).

Data from January 26 to January 30 shows that BlackRock offloaded approximately $947 million worth of Bitcoin through its iShares Bitcoin Trust (IBIT), alongside about $264 million of Ethereum via its iShares Ethereum Trust (ETHA).

The most intense Bitcoin selling occurred toward the end of the week. On January 29, IBIT recorded net outflows of roughly $318 million, followed by an even larger $528 million exit the next day.

Earlier in the week, selling pressure was also persistent, with an additional $103 million in outflows on January 27, only partially offset by a modest inflow at the start of the period. These outflows have partly contributed to the continued plunge in Bitcoin, which has since lost the $80,000 support zone.

Total Bitcoin spot ETF net inflow. Source: Coinglass

Total Bitcoin spot ETF net inflow. Source: Coinglass

By press time, Bitcoin was valued at $78,461, down more than 6% over the past 24 hours. On a weekly basis, the cryptocurrency has corrected by over 11%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

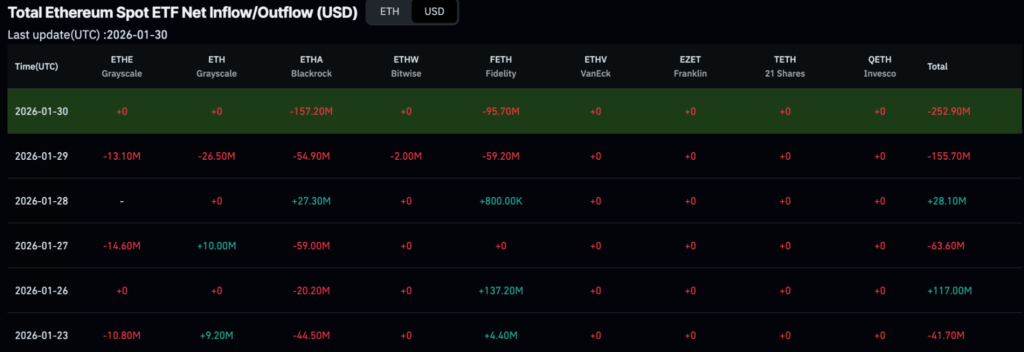

BlackRock Ethereum outflows

Ethereum mirrored this pattern, though on a smaller scale. ETHA experienced steady selling throughout the week, culminating in a significant $157 million outflow on January 30 after already shedding nearly $55 million the previous day.

While January 28 briefly saw a $27 million inflow, it proved insufficient to counterbalance the broader trend, leaving Ethereum ETFs firmly in net outflow territory by week’s end.

Total Ethereum spot ETF net inflow. Source: Coinglass

Total Ethereum spot ETF net inflow. Source: Coinglass

Overall, BlackRock’s activity unfolded amid widespread weakness across U.S.-listed crypto ETFs. Bitcoin spot ETFs collectively posted multiple consecutive days of net outflows, including a nearly $818 million exit on January 29 alone, signaling that selling pressure extended well beyond a single issuer.

Ethereum ETFs also recorded persistent withdrawals, pointing to a broader pullback from digital asset exposure among institutional investors. To this end, the Ethereum price is also under pressure, dropping over 10% in the past 24 hours to trade at $2,415 as of press time.

The scale and timing of the outflows suggest that late January’s crypto ETF selling was not driven by isolated fund rebalancing, but rather by a broader reassessment of market conditions.

With Bitcoin and Ethereum prices both under pressure during the period, ETF flows indicate that large investors opted to de-risk aggressively heading into February.

Featured image via Shutterstock