Trader with 100% win rate goes long on these 3 cryptocurrencies

![]() Cryptocurrency Nov 2, 2025 Share

Cryptocurrency Nov 2, 2025 Share

Although the cryptocurrency market is cooling down, with most assets in a state of uncertainty, a trader boasting a 100% win rate has once again gone long on Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

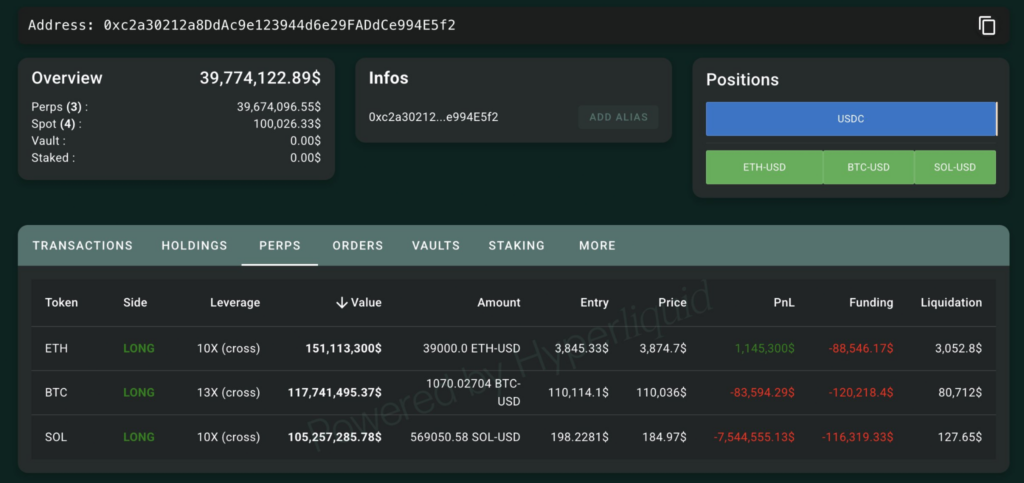

Specifically, the trader currently holds 39,000 ETH worth $151 million at an average entry of $3,845.33, 1,070 BTC valued at $118 million at $110,114.10, and 569,050 SOL worth $105 million at $198.23, according to the latest on-chain data retrieved from Lookonchain by Finbold on November 2.

Crypto trader’s long position. Source: Lookonchain

Crypto trader’s long position. Source: Lookonchain

He has also placed limit orders to add 40,000 SOL about $7.36 million to his long position at $184, showing confidence in Solana’s potential rebound despite recent volatility.

This move follows his previous set of trades on October 30, when he also went long on the same three assets, holding 1,039 BTC worth $114 million, 560,840 SOL valued at $109 million, and 13,419 ETH worth $52.66 million.

Interestingly, over an 18-day period, the trader completed 14 trades with a 100% win rate, realizing more than $16 million in profit.

With the trader going long again, it appears he’s betting on a market rebound, signaling strong confidence in a potential rally.

Bitcoin fails to make major moves

Notably, the market, led by Bitcoin, briefly rebounded after suffering steep losses earlier in the week, stabilizing around the $110,000 level as both bulls and bears showed little conviction to push prices decisively either way.

As of press time, Bitcoin was trading at $110,734, up about 0.5% in the past 24 hours, while Ethereum was at $3,872, down less than 0.1% over the same period.

Notably, the bearish sentiment follows Bitcoin’s first monthly loss since 2018, ending a seven-year streak that once made October a “lucky” month for crypto traders.

The broader market also mirrored declines in gold and equities, retreating from record highs amid rising investor uncertainty. The sell-off intensified after U.S. President Donald Trump imposed a 100% tariff on Chinese imports and hinted at export restrictions on key software, triggering the largest crypto liquidation on record. Despite easing trade tensions, the market has shown little sign of recovery.

Prices remain partly weighed down as institutional investors stay cautious, with exchange-traded funds (ETFs) witnessing notable outflows in the past week. A resumption of inflows could, however, trigger renewed bullish sentiment.

Featured image via Shutterstock